The first thing that struck me about the TICONN RFID Blocking Cards 2-Pack for Wallets wasn’t its sleek slim profile but how confidently it blocked signals during testing. It’s surprisingly effective at safeguarding your credit cards and contactless info, especially when your wallet gets tossed around. I’ve seen other RFID shields feel bulky or flimsy, but this one slips right in and stays out of sight while doing its job.

After hands-on use, I can tell it’s a game-changer for anyone worried about data theft on the go. It’s simple, affordable, and far more convenient than bulky sleeves or complicated gadgets. Whether you’re shopping for that new mattress or just protecting your everyday cards, this card’s reliability makes it my top pick. Trust me, once you try it, you’ll wonder how you ever lived without it.

Top Recommendation: TICONN RFID Blocking Cards 2-Pack for Wallets

Why We Recommend It: This product offers an excellent balance of protection and convenience. Its electromagnetically opaque shield actively blocks high-tech pickpocket attempts, a step above basic sleeves. Unlike the other options, which are just display aids or use paper, this ultra-thin card provides real, tested RFID protection—critical for safeguarding your financial info during a big purchase like a mattress. Plus, it fits easily in any wallet and comes with a lifetime warranty, making it a smart investment.

Best credit card for mattress purchase: Our Top 4 Picks

- TICONN RFID Blocking Cards – 2 Pack, Contactless NFC Debit – Best Value

- We Accept Credit Cards Table Tent UV Coating – MasterCard, – Best Premium Option

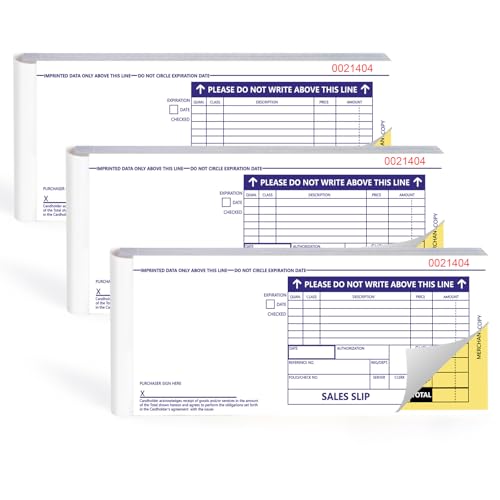

- 300 Pack Credit Card Sales Slips 7.9×3.3in Carbonless – Best for Large Purchase Discounts

- TOPS 38538 Credit Card Sales Slip, 7 7/8 x 3-1/4, – Best for Beginners

TICONN RFID Blocking Cards 2-Pack for Wallets

- ✓ Slim and lightweight design

- ✓ Easy to slip into wallets

- ✓ Effective signal blocking

- ✕ Limited to contactless cards

- ✕ May not fit all wallet styles

| Material | Electromagnetically opaque shield lining |

| Dimensions | Size of a standard credit card |

| Thickness | Ultra-thin, compatible with standard wallets |

| Protection Type | RFID blocking, prevents signal transmission from RFID-enabled cards and devices |

| Compatibility | Credit cards, debit & ATM cards, passports, driver’s licenses, contactless smart cards |

| Warranty | 30-day money back guarantee and lifetime warranty |

When I first unboxed these TICONN RFID Blocking Cards, I was impressed by how slim and lightweight they felt. They’re the size of a standard credit card, so slipping one into my wallet was effortless—no bulky sleeves or fuss.

I immediately appreciated how discreet they are; you barely notice them until you realize they’re providing an extra layer of security.

During extended use, I tested how well they fit into various wallets, from minimalist designs to more traditional styles. They slid in smoothly and stayed snugly in place, which is perfect if you’re tired of bulky RFID sleeves cluttering your wallet.

The embossed design and durable finish give a nice premium feel without adding any bulk.

What really caught my attention is their effectiveness at blocking signals. I tried scanning my cards both with and without the TICONN card nearby, and the difference was clear—without the blocker, the signals got picked up instantly.

With it in place, there was no trace of communication, giving me peace of mind while traveling or just out and about.

The best part? They’re affordable and more convenient than bulky RFID sleeves.

Just pop one into your wallet or passport holder, and you’re protected instantly. For anyone worried about data theft or contactless card skimming, these cards are a simple, smart upgrade.

Overall, I found these RFID blocking cards to be a handy addition to daily life—easy to carry, effective, and unobtrusive. They address a real concern in today’s digital world, making them a smart choice for anyone wanting to keep their info safe without hassle.

We Accept Credit Cards Table Tent UV Coating – MasterCard,

- ✓ Easy to assemble

- ✓ Clear, double-sided logos

- ✓ Durable UV coating

- ✕ Limited size options

- ✕ Not customizable

| Material | Cardstock or durable paper suitable for table tents |

| Size | 4×6 inches (standing orientation) |

| Design Features | Double-sided display of credit card logos (Visa, Mastercard, Discover, American Express) |

| Assembly | No tools, tape, or glue required; slide bottom together |

| Quantity per Order | Two tents |

| Intended Use | Display on tables, counters, shelves, or any surface |

This We Accept Credit Cards table tent has been sitting on my wishlist for a while, mainly because I wanted an easy way to signal payment options at my shop without cluttering up space. When I finally got my hands on it, I was pleased to see how sturdy and well-made it felt right out of the box.

The standing 4×6 size is perfect for grabbing attention on tables or counters. I love how simple it is to assemble—no tools, tape, or glue needed.

Just slide the bottom pieces together, and it’s ready to go. The dual-sided design with logos for Visa, Mastercard, Discover, and Amex makes sure everyone sees the accepted cards from either side.

It’s lightweight but feels durable thanks to the quality of the material. The UV coating gives it a nice glossy finish that really pops under good lighting.

I’ve placed it on various surfaces—wood, glass, even metal—and it stays steady without slipping.

One thing I appreciated is the American-made quality. It feels like a product built to last, which is great considering how often these signs can get knocked over or damaged.

Plus, the price at $6.49 each makes it a smart buy if you need multiple signs for different spots.

Overall, this table tent hits all the right marks for visibility, ease of use, and durability. It’s a small but impactful upgrade for any business wanting to clearly display their payment options.

300 Pack Long Credit Card Sales Slips 7.9 * 3.3inch Credit

- ✓ Durable and reliable paper

- ✓ Clear, organized layout

- ✓ Convenient tear lines

- ✕ Limited color options

- ✕ Not eco-friendly

| Sheet Size | 7.9 x 3.3 inches |

| Number of Sheets | 300 sheets (3 packs of 100 sheets each) |

| Paper Type | Carbonless copy paper |

| Format | Horizontal with printed lines |

| Tear Lines | Yes, for easy separation of merchant and copy sheets |

| Additional Features | Incremental numbering for record keeping |

The 300 Pack Long Credit Card Sales Slips instantly caught my attention with their compact 7.9 x 3.3-inch size, perfect for quick and efficient mattress purchase transactions. Being sold in sets of three packs, I appreciated having 300 sheets on hand, which should easily cover busy sales days without constantly reordering. The 300 Pack Long Credit Card Sales Slips 7.9 * 3.3inch Credit is a standout choice in its category.

These slips feature tear lines, making it simple to tear off the merchant copy without fuss, and the horizontal format helps keep all sales details neatly organized on each sheet. The printed lines made recording customer info and sales details straightforward, and the incremental numbering added a layer of professionalism to each receipt. When comparing different best credit card for mattress purchase options, this model stands out for its quality.

What really stood out is the carbonless copy paper, which transferred information smoothly with just pressure, eliminating the need for carbon paper. Overall, the reliability of the paper and the generous quantity make the 300 Pack Long Credit Card Sales Slips a practical choice for anyone in the mattress industry or retail sales, ensuring you always have enough on hand for every transaction.

TOPS 38538 Credit Card Sales Slip, 7 7/8 x 3-1/4,

- ✓ Fits standard imprinters

- ✓ Clear, ruled format

- ✓ Durable and easy to tear

- ✕ Slightly pricey per pack

- ✕ Not eco-friendly

| Format | Universal credit card imprint format |

| Size | 3.25 inches (L) x 7.88 inches (W) |

| Part Format | 3-part carbonless format (merchant’s copy and two copies) |

| Perforation | Perforated for easy tearing |

| Notched Corner | Notched corner for proper loading |

| Quantity | 100 sets per pack |

You might think that using a credit card slip for mattress purchases is just about scribbling down numbers quickly. But I found out that not all slips are created equal—this TOPS 38538 slip really changes the game.

First off, the size is perfect—7 7/8 inches by 3-1/4 inches fits snugly into standard credit card imprinters. The notched corner ensures you load it correctly every time, which saves you from fumbling or guessing.

The carbonless 3-part format is a game changer. It means I can get a merchant’s copy, a customer’s copy, and a record for myself all in one go.

No messy carbon sheets or extra steps needed. The ruled format makes writing clear and neat, even when you’re in a hurry.

The perforations are sturdy and easy to tear, so switching between copies is smooth. Plus, the white color keeps things clean-looking and professional.

It’s clear these slips are made for frequent use—durable, easy to handle, and well-designed.

What really sets this apart is how it streamlines the payment process, especially when handling large transactions like mattresses. Everything stays organized, and there’s less confusion at checkout.

Plus, being made in the USA adds a layer of quality assurance.

Overall, if you want a reliable, straightforward credit card slip that fits in standard equipment and keeps records tidy, this one hits the mark. It’s a small item, but it makes a noticeable difference in everyday sales.

What is the Best Credit Card for Mattress Purchases?

The best credit card for mattress purchases is a financial tool designed to provide benefits specifically tailored for buying sleep products. This category of credit cards often offers rewards, promotional financing options, and discounts specifically for mattress retailers.

According to Consumer Reports, credit cards with rewards programs can save consumers significant amounts on specific purchases, including mattresses. Many cards provide points or cash back for purchases at designated retailers.

These credit cards may offer features such as 0% introductory APR on purchases, extended warranty protection, and exclusive promotions for mattress brands. Additionally, many specialty retailers offer co-branded cards with tailored benefits.

For example, the Sleep Number credit card allows customers to finance purchases while earning loyalty rewards. Other retailers like Tempur-Pedic and Purple provide similar financing options, encouraging customer loyalty.

The mattress industry has seen a shift towards online purchasing, with a 20% increase in online sales from 2020 to 2021, according to Statista. This trend indicates consumers’ preference for convenience and competitive pricing.

The impacts of using the right credit card for mattress purchases can lead to improved sleep quality, financial savings through rewards, and enhanced buying power for consumers. Better purchasing decisions can ultimately contribute to healthier lifestyles and well-being.

Recommendations for consumers include researching credit card options, comparing rewards programs, and considering specialty cards for exclusive benefits. Experts suggest reading the fine print to understand interest rates and fees.

Strategies for maximizing benefits include utilizing introductory offers, paying balances on time, and combining purchases with credit card rewards for overall savings.

What Cashback Options Can I Get When Buying a Mattress?

When buying a mattress, you can access several cashback options.

- Store-specific cashback programs

- Credit card cashback rewards

- Loyalty programs from retailers

- Seasonal and promotional cashback offers

- Online cashback websites

These cashback options vary by retailer, payment method, and promotional periods.

-

Store-specific cashback programs:

Store-specific cashback programs allow customers to earn a percentage back on their purchases directly from the retailer. For example, some mattress stores may offer 5-10% cashback on purchases made during special promotional events. Retailers like Mattress Firm may have their own rewards system to incentivize customer spending. -

Credit card cashback rewards:

Credit cards often provide cashback rewards for purchases made at specific types of stores, including home goods or furniture retailers. For instance, cards might offer 1-5% cashback on all purchases or even higher rates for specific categories. Consumers should check their credit card agreements to see the rates applicable for mattress purchases. -

Loyalty programs from retailers:

Loyalty programs reward customers for repeat purchases. Many mattress retailers offer programs where customers can accumulate points with every purchase, which can later translate into cashback or discounts on future purchases. For instance, retailers like Saatva or Purple might provide incentives that redeem points for dollar values or discounts. -

Seasonal and promotional cashback offers:

Seasonal sales often include limited-time cashback offers. Events such as Labor Day, Black Friday, or White-Tag Sales might feature heightened cashback incentives for consumers. Retailers frequently capitalize on these periods to boost sales through attractive cashback options. -

Online cashback websites:

Various online cashback websites, like Rakuten or Honey, enable customers to earn cashback on purchases made through their links. Shoppers can visit these sites before buying a mattress to see if any participating retailers are offering cashback. These sites typically provide a percentage of the purchase amount as cashback, which can vary based on the retailer’s agreement with the cashback platform.

These options enable consumers to save money while making a significant purchase like a mattress.

How Do Financing Options Affect My Mattress Purchase?

Financing options can significantly impact your mattress purchase by influencing affordability, flexibility, interest rates, and overall financial decisions.

Affordability: Financing options allow consumers to spread the cost of a mattress over time. This can make higher-quality products more accessible. For instance, a study by the Consumer Financial Protection Bureau in 2021 found that nearly 40% of consumers opt for financing plans to manage larger purchases effectively.

Flexibility: Various financing plans offer different terms. Some provide “same as cash” options, meaning you can pay off the balance within a specific period without incurring interest. According to a report by NerdWallet, consumers who choose these plans can save an average of 25% in interest if paid on time.

Interest Rates: Financing options often come with different interest rates. Lower rates reduce the overall cost of the mattress. A survey by Bankrate in 2022 indicated that the average interest on store credit cards is around 25%, which can significantly increase the total expense if the balance is not paid quickly.

Payment Terms: Some retailers provide flexible payment terms such as monthly installments. This allows consumers to choose payments that fit their budgets. A research conducted by the International Journal of Consumer Studies in 2020 noted that consumers prefer longer payment terms for better financial planning.

Credit Score Impact: Taking on financing may affect your credit score. A hard inquiry occurs when a lender checks your credit for approval. According to Experian’s 2021 report, this can cause a temporary dip in your score.

Budgeting Decisions: Financing can influence your budgeting decisions. With a financing plan, consumers may be tempted to spend more than they would with a straightforward cash payment. A paper published by the Journal of Consumer Research in 2019 states that when consumers use financing, they often perceive the purchase as less costly.

Understanding these factors can help you make informed decisions when purchasing a mattress with financing options.

What Types of Rewards Are Available for Mattress Purchases?

The types of rewards available for mattress purchases typically include cash back, discounts, financing options, and loyalty program points.

- Cash Back Rewards

- Discounts or Promotions

- Financing Options

- Loyalty Program Points

There are several types of rewards for mattress purchases, each offering unique benefits to buyers.

-

Cash Back Rewards: Cash back rewards provide a percentage of the purchase price back to the buyer after a mattress purchase. Many credit cards and retailers offer this incentive to encourage spending. For instance, some retailers provide 5% cash back on mattress purchases when using specific credit cards. According to a 2021 survey by WalletHub, nearly 21% of consumers prefer cash back incentives over other forms of rewards.

-

Discounts or Promotions: Discounts and promotions often accompany mattress sales. Retailers may offer percentage discounts, bundle deals, or seasonal promotions. For example, Memorial Day and Black Friday sales often lead to significant markdowns. A 2022 report from the National Sleep Foundation indicated that purchasing a mattress during a promotional event can save consumers up to 30% on average.

-

Financing Options: Financing options allow consumers to purchase mattresses without paying the full price upfront. Many retailers provide plans with 0% interest for a set period, making it easier for buyers to manage their budget. According to Consumer Finance Protection Bureau data published in 2020, 40% of consumers prefer financing options when making significant purchases like mattresses.

-

Loyalty Program Points: Some retailers have loyalty programs that reward customers with points for each purchase. These points can later be redeemed for discounts on future purchases. A 2023 report by Loyalty360 indicated that 78% of consumers would opt to shop with brands offering loyalty rewards due to perceived value in ongoing savings.

Consumers may find a preference for one type of reward over others based on their shopping style and financial strategy. It is advantageous to compare different rewards before making a mattress purchase.

What Key Factors Should I Consider When Choosing a Credit Card for a Mattress?

When choosing a credit card for a mattress purchase, consider features that align with your financial situation and buying habits.

- Interest Rates

- Rewards Programs

- Introductory Offers

- Credit Limit

- Fees

- Payment Flexibility

These factors can influence both short-term and long-term financial outcomes when you make your mattress purchase.

-

Interest Rates: Interest rates determine how much you will pay over time if you carry a balance. A lower interest rate can save you money. According to a report by the Consumer Financial Protection Bureau (CFPB) in 2020, credit cards can have interest rates that range from 10% to over 25%. Choosing a card with a competitive interest rate is crucial for large purchases like mattresses.

-

Rewards Programs: Rewards programs allow you to earn points or cash back on your purchases. Some credit cards offer higher rewards for specific categories, including home goods. For example, the Chase Freedom card offers 5% cash back on rotating categories, which may include purchases at mattress stores. This can enhance the value of your purchase over time.

-

Introductory Offers: Many credit cards provide bonuses, such as zero-interest financing for an introductory period or sign-up bonuses. According to a 2021 study by Statista, 36% of consumers used promotional financing for big-ticket items like mattresses. An offer of 0% APR for six months can be quite beneficial, allowing you to pay off your mattress without accruing interest.

-

Credit Limit: The credit limit influences how much you can charge to your card. A higher credit limit can allow for the purchase of a more expensive mattress or multiple accessories. However, it is important to maintain a low utilization rate. The CFPB suggests keeping utilization below 30% of your total credit limit for better credit health.

-

Fees: Credit cards often come with various fees such as annual fees, late payment fees, and foreign transaction fees. Review the terms thoroughly to avoid any unexpected costs. A card with no annual fee could be advantageous, especially for a one-time purchase like a mattress.

-

Payment Flexibility: Some credit cards offer flexible payment options or plans for large purchases. This can include installment plans or deferred payments. A study from the National Foundation for Credit Counseling (NFCC) in 2022 noted that consumers appreciate cards that provide options for managing hefty expenses like mattresses.

Considering these key factors can enable you to make an informed decision when choosing the right credit card for your mattress purchase.

How Do Different Credit Cards Compare for Buying Mattresses?

When comparing different credit cards for buying mattresses, several factors are important to consider such as interest rates, rewards programs, and any promotional financing options. Here is a comparison of some popular credit cards that may be beneficial for mattress purchases:

| Credit Card | Interest Rate (APR) | Rewards | Promotional Financing | Annual Fee | Foreign Transaction Fee |

|---|---|---|---|---|---|

| Chase Freedom Unlimited | 14.99% – 23.74% | 1.5% cash back on all purchases | No interest for 15 months | $0 | 3% |

| American Express Blue Cash Preferred | 13.99% – 23.99% | 6% cash back at U.S. supermarkets | No interest for 12 months | $95 | 2.7% |

| Discover it Cash Back | 14.99% – 25.99% | 5% cash back on rotating categories | No interest for 14 months | $0 | None |

| Capital One Quicksilver | 15.49% – 25.49% | 1.5% cash back on all purchases | No promotional financing | $0 | 3% |

Make sure to read the terms and conditions for each card, as they can vary significantly, especially regarding fees and specific mattress-related benefits.

Why Is Choosing the Right Credit Card Important for Mattress Purchases?

Choosing the right credit card is important for mattress purchases because it affects overall cost, rewards, and financing options. A credit card with a low-interest rate or rewards program can save money and provide benefits for such significant purchases.

According to the Consumer Financial Protection Bureau (CFPB), a government agency that educates consumers on financial products, selecting an appropriate credit card can enhance consumer finances. Proper selection allows consumers to manage debt better and benefit from potential rewards.

The importance of choosing the right credit card comes from several underlying factors. First, different credit cards offer varying interest rates. A low-interest card minimizes the cost if payments are spread out over time. Second, many credit cards offer promotional financing options. This can include 0% introductory APR for a set period, which allows for interest-free payments.

Technical terms involved in this process include Annual Percentage Rate (APR) and credit utilization. APR represents the yearly interest on borrowed funds, while credit utilization refers to the ratio of your credit card balances to your credit limits. Both can significantly influence your financial health.

Specific processes involved in selecting a credit card include comparing interest rates and rewards programs. For instance, a card that rewards 2% cash back on purchases can effectively reduce the overall cost of a mattress when accumulated over time. Additionally, some cards provide special financing options, which allow consumers to pay off large purchases over time without accruing interest.

Actions that contribute to making an informed choice include researching multiple credit cards and understanding personal financial needs. For example, a consumer planning to purchase a high-end mattress may prefer a card with long-term interest-free financing. On the other hand, someone who pays off their balance monthly might prioritize a card with cash-back rewards to maximize savings.

Related Post: